The Stats

"The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 2,163 in April 2025, a 23.6 per cent decrease from the 2,831 sales recorded in April 2024. This was 28.2 per cent below the 10-year seasonal average (3,014).

There were 6,850 detached, attached and apartment properties newly listed for sale on the MLS® in Metro Vancouver in April 2025. This represents a 3.4 per cent decrease compared to the 7,092 properties listed in April 2024 and was 19.5 per cent above the 10-year seasonal average (5,731) for the month.

The total number of properties currently listed for sale on the MLS® system in Metro Vancouver is 16,207, a 29.7 per cent increase compared to April 2024 (12,491). This is 47.6 per cent above the 10-year seasonal average (10,979)." (GVR April 2025 Residential Market Report.)

There were 6,850 detached, attached and apartment properties newly listed for sale on the MLS® in Metro Vancouver in April 2025. This represents a 3.4 per cent decrease compared to the 7,092 properties listed in April 2024 and was 19.5 per cent above the 10-year seasonal average (5,731) for the month.

The total number of properties currently listed for sale on the MLS® system in Metro Vancouver is 16,207, a 29.7 per cent increase compared to April 2024 (12,491). This is 47.6 per cent above the 10-year seasonal average (10,979)." (GVR April 2025 Residential Market Report.)

Giving Uncertainty Vibes

If you had asked me six months ago how 2025 was going to pan out, I would have predicted a steady market with a slight but healthy increase in sales and prices into 2026. This assessment was based on home sales picking up considerably at the end of 2024 and into the start of 2025, paired with consistent rate decreases. However, these past few months have been slower than anticipated, especially given the significantly improved borrowing conditions. This slow-down can be traced to a general feeling of uncertainty among home owners, investors and the broader market, brought on by the erratic US trade policy and, to a lesser extent, our own recent elections.

So how can we assess this situation and not just go on "vibes"? Let's first consider that today we have more access to more news sources than ever before, and digital media focuses on stories that will gain the most clicks as a means of revenue, and ultimately, survival. There is also a tendency towards sensationalizing the news rather than offering a more nuanced approach that is less likely to get online traction. The news certainly never makes me feel better and I can understand how it may lead to greater fear and even doomerism among the greater public.

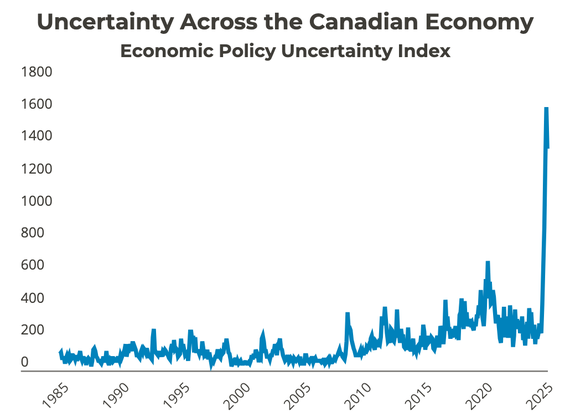

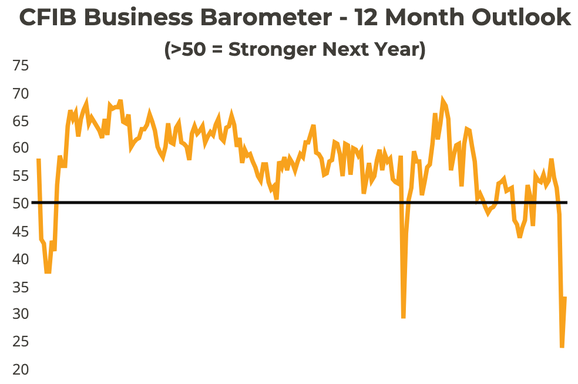

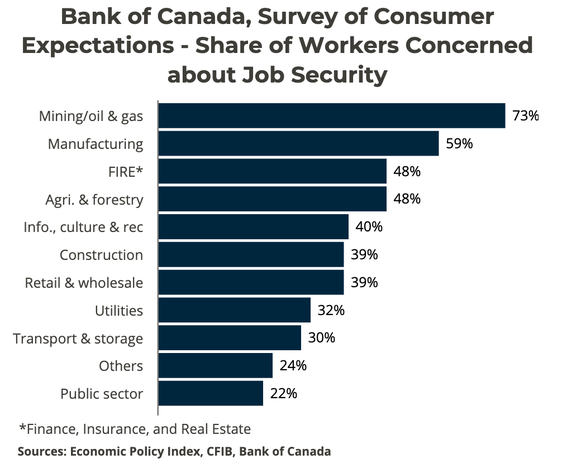

And while feelings of uncertainty are not easily measured, there are some tools and we can use to gain valuable insight into the situation.

- The Economic Policy Uncertainty Index scrapes Canadian media for mentions of economic uncertainty. The index rose to a record high of 1,635 in February 2025, with its previous record being 679 at the start of the pandemic in 2020.*

- The Canadian Federation of Independent Business (CFIB) business barometer collapsed in February following the T**** administration’s tariff policy.*

- A recent Bank of Canada (BOC) survey shows that Canadian workers that rely on import/export to the US are worried about job security.*

More concretely, the EPUI estimates that uncertainty has reduced home sales by 3,000 individual sales in 2025 Q1.* Nothing stalls high stakes decision-making like uncertainty.

But it won't last forever… right?

As with all market trends and anomalies, nothing is permanent and I remain hard at work and optimistic. But I'm also a realist and can empathize with my clients' concerns. However, with the Canadian election behind us and the initial shock of a trade war appearing to be subsiding, a return to normalcy likely depends on the final shape of the tariff conditions. Should the US and Canada reach a mutually beneficial agreement to end the tariff war, combined with pent-up demand, we should see sales increase. Here's to hoping that T****’s new toy from Qatar keeps him busy and that wiser heads prevail in upcoming trade talks.